The Mezcal boom in Canada

The Mezcal boom in Canada

The Mezcal boom in Canada

Will Canada catch-up to the growth in the US market?

Will Canada catch-up to the growth in the US market?

Will Canada catch-up to the growth in the US market?

Nov 6, 2023

Nov 6, 2023

Nov 6, 2023

Mezcal in Canada

Despite a 70% increase in search interest over the past five years, Mezcal holds just a 1.5% share of Ontario's agave spirits market, dwarfed by Tequila's dominance. This article explores Mezcal's market potential in Canada, contrasted with its strong growth in the U.S., and considers what could fuel its expansion in the Canadian spirits industry.

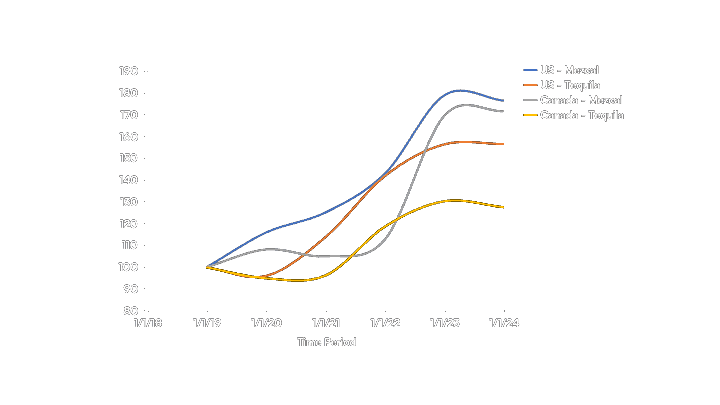

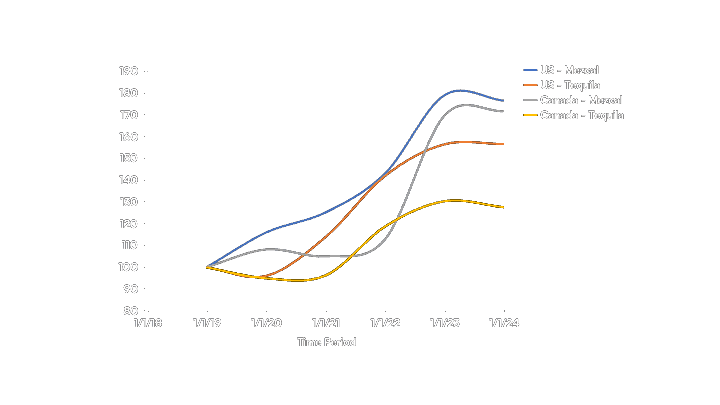

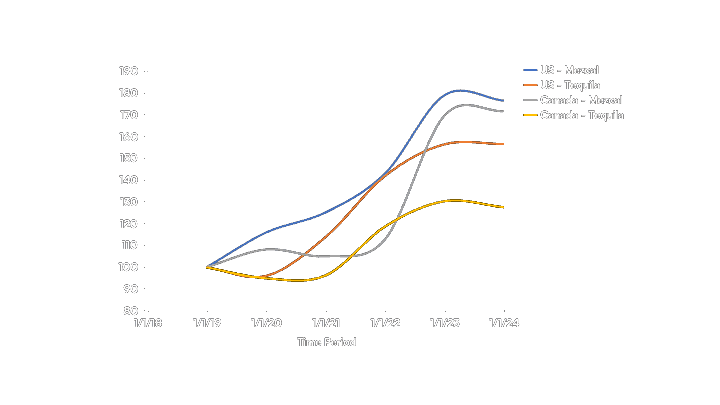

Search interest is up 70% for Mezcal over the past 5 years

Google Trends data from the past five years indicates a 70% increase in Mezcal searches in Canada, compared to a 27% increase for Tequila. This spike in interest suggests a growing awareness and potential consumer base for Mezcal.

source: Google Trends data, past 5 years.

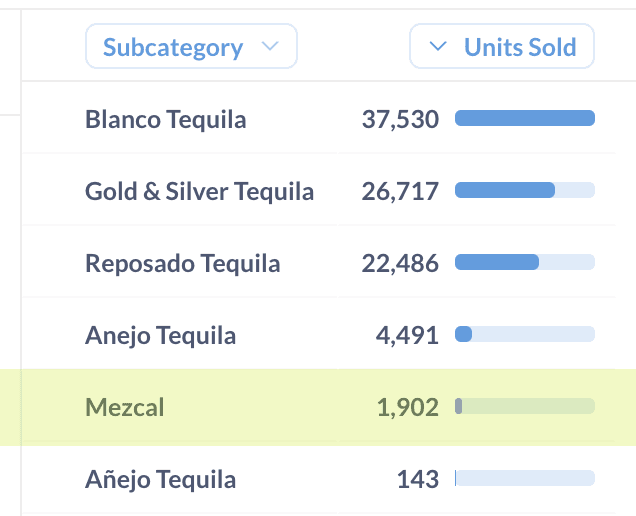

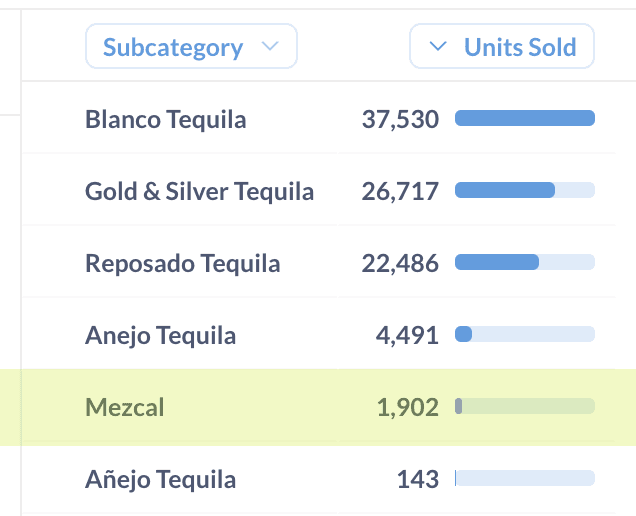

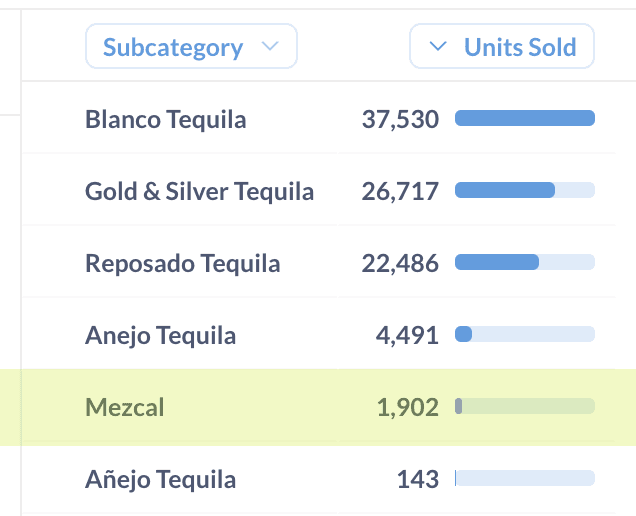

In Ontario, Mezcal still only has a 1.5% share of Agave spirits

According to our recent estimate, Tequila commands more than a 98% share of unit sales in Ontario. In stark contrast, Mezcal's market presence is significantly smaller, with only a 1.5% share of off-premise sales in the region.

source: Shelfbase estimate for Ontario market, past 14 days.

However, this modest share contrasts sharply with a 7% market share in the U.S., according to the International Wine and Spirits Record (IWSR), which may include on-premise consumption. The difference highlights a significant opportunity for Mezcal to grow within Ontario's retail spirits market.

The U.S. Market as a Benchmark

The growth rate of Mezcal in the U.S. stands at an impressive 27%, far outpacing Tequila's 8.9%. This stark difference underscores the untapped potential of Mezcal in Ontario's market, which could follow the upward trend seen in the United States.

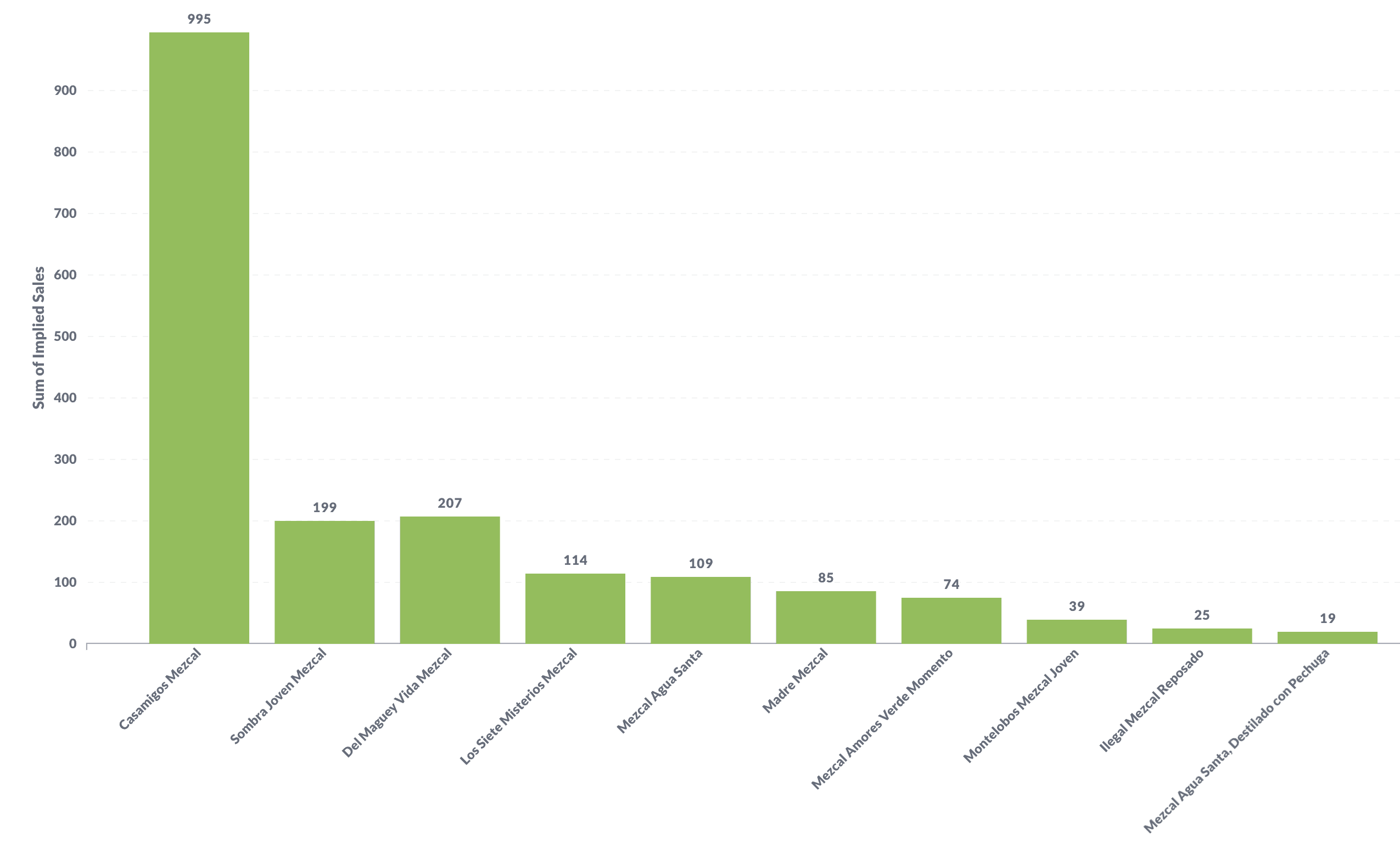

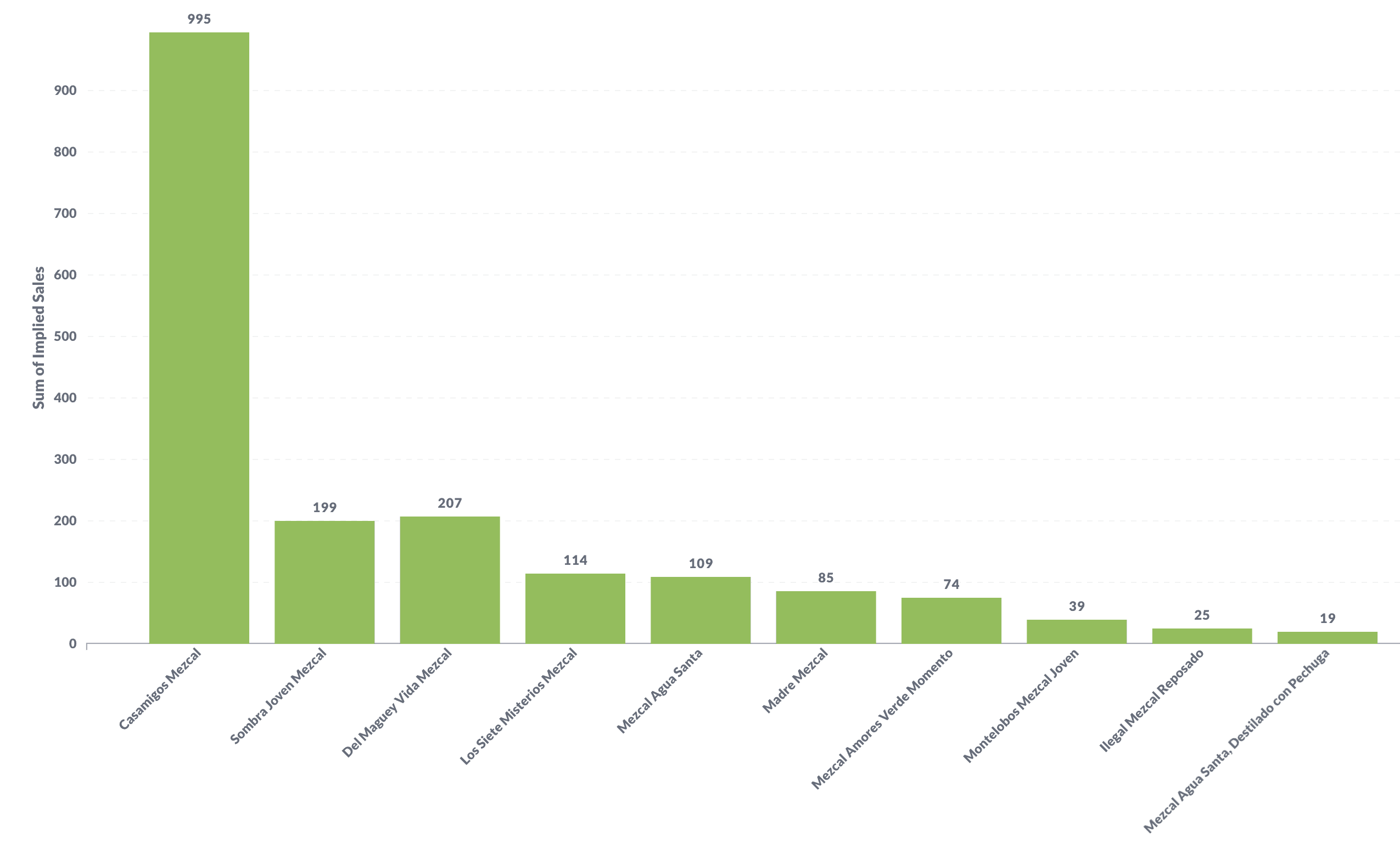

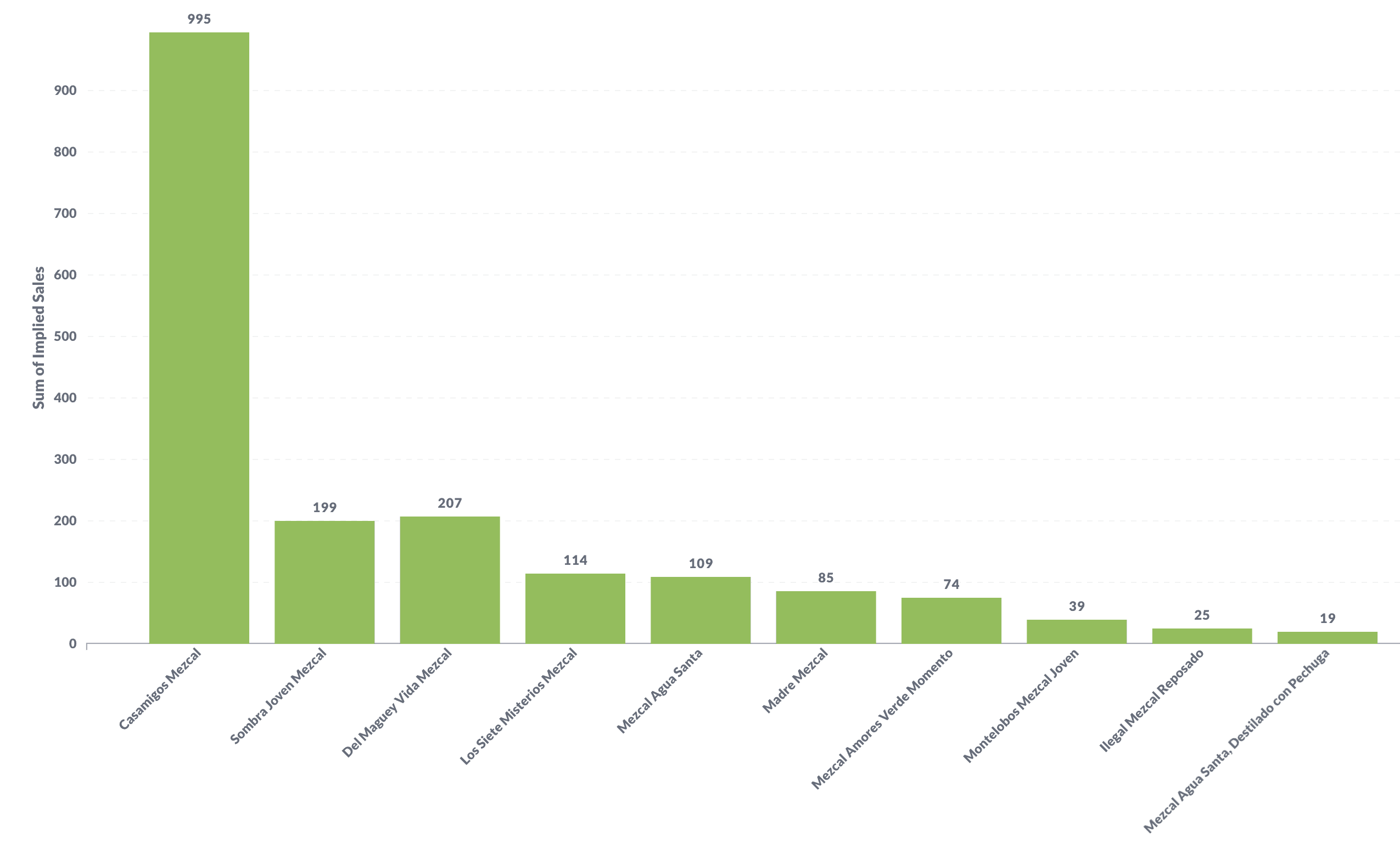

Casamigos dominates the category despite the premium price

Interestingly, Casamigos Mezcal leads the pack in sales, with 995 units sold in the Ontario region. Its success, even with a premium price tag, could point to Casamigos' substantial brand influence or a wider consumer shift towards high-end spirits.

Illegal Mezcal is a top product in US market, but not yet performing in Canada

In the U.S., Illegal Mezcal is a top performer in its category. However, in Canada, this brand has not yet replicated its American success, accounting for a mere 2% of Mezcal unit sales in recent weeks. This contrast presents an intriguing case study on brand penetration and market adaptation.

Source: Spec's Wine, Spirits, & Foods

Our Perspective: Predicting Canada's Trajectory

Mezcal in Canada should experience a significant boom, closing the gap in market penetration when compared to its neighbor to the south.

The stage is set for an accessible, brand-oriented Mezcal brand to become the go-to choice for Canadians exploring this spirit for the first time. Whether it's an established name like Madre or a new entrant seizing the market opportunity, the future looks bright for Mezcal's integration into the fabric of Canada's spirit preferences.

With strategic positioning and an understanding of consumer preferences, brands have the opportunity to tap into a market that is only just beginning to explore the rich and varied nuances of this distinctive spirit.

Mezcal in Canada

Despite a 70% increase in search interest over the past five years, Mezcal holds just a 1.5% share of Ontario's agave spirits market, dwarfed by Tequila's dominance. This article explores Mezcal's market potential in Canada, contrasted with its strong growth in the U.S., and considers what could fuel its expansion in the Canadian spirits industry.

Search interest is up 70% for Mezcal over the past 5 years

Google Trends data from the past five years indicates a 70% increase in Mezcal searches in Canada, compared to a 27% increase for Tequila. This spike in interest suggests a growing awareness and potential consumer base for Mezcal.

source: Google Trends data, past 5 years.

In Ontario, Mezcal still only has a 1.5% share of Agave spirits

According to our recent estimate, Tequila commands more than a 98% share of unit sales in Ontario. In stark contrast, Mezcal's market presence is significantly smaller, with only a 1.5% share of off-premise sales in the region.

source: Shelfbase estimate for Ontario market, past 14 days.

However, this modest share contrasts sharply with a 7% market share in the U.S., according to the International Wine and Spirits Record (IWSR), which may include on-premise consumption. The difference highlights a significant opportunity for Mezcal to grow within Ontario's retail spirits market.

The U.S. Market as a Benchmark

The growth rate of Mezcal in the U.S. stands at an impressive 27%, far outpacing Tequila's 8.9%. This stark difference underscores the untapped potential of Mezcal in Ontario's market, which could follow the upward trend seen in the United States.

Casamigos dominates the category despite the premium price

Interestingly, Casamigos Mezcal leads the pack in sales, with 995 units sold in the Ontario region. Its success, even with a premium price tag, could point to Casamigos' substantial brand influence or a wider consumer shift towards high-end spirits.

Illegal Mezcal is a top product in US market, but not yet performing in Canada

In the U.S., Illegal Mezcal is a top performer in its category. However, in Canada, this brand has not yet replicated its American success, accounting for a mere 2% of Mezcal unit sales in recent weeks. This contrast presents an intriguing case study on brand penetration and market adaptation.

Source: Spec's Wine, Spirits, & Foods

Our Perspective: Predicting Canada's Trajectory

Mezcal in Canada should experience a significant boom, closing the gap in market penetration when compared to its neighbor to the south.

The stage is set for an accessible, brand-oriented Mezcal brand to become the go-to choice for Canadians exploring this spirit for the first time. Whether it's an established name like Madre or a new entrant seizing the market opportunity, the future looks bright for Mezcal's integration into the fabric of Canada's spirit preferences.

With strategic positioning and an understanding of consumer preferences, brands have the opportunity to tap into a market that is only just beginning to explore the rich and varied nuances of this distinctive spirit.

Mezcal in Canada

Despite a 70% increase in search interest over the past five years, Mezcal holds just a 1.5% share of Ontario's agave spirits market, dwarfed by Tequila's dominance. This article explores Mezcal's market potential in Canada, contrasted with its strong growth in the U.S., and considers what could fuel its expansion in the Canadian spirits industry.

Search interest is up 70% for Mezcal over the past 5 years

Google Trends data from the past five years indicates a 70% increase in Mezcal searches in Canada, compared to a 27% increase for Tequila. This spike in interest suggests a growing awareness and potential consumer base for Mezcal.

source: Google Trends data, past 5 years.

In Ontario, Mezcal still only has a 1.5% share of Agave spirits

According to our recent estimate, Tequila commands more than a 98% share of unit sales in Ontario. In stark contrast, Mezcal's market presence is significantly smaller, with only a 1.5% share of off-premise sales in the region.

source: Shelfbase estimate for Ontario market, past 14 days.

However, this modest share contrasts sharply with a 7% market share in the U.S., according to the International Wine and Spirits Record (IWSR), which may include on-premise consumption. The difference highlights a significant opportunity for Mezcal to grow within Ontario's retail spirits market.

The U.S. Market as a Benchmark

The growth rate of Mezcal in the U.S. stands at an impressive 27%, far outpacing Tequila's 8.9%. This stark difference underscores the untapped potential of Mezcal in Ontario's market, which could follow the upward trend seen in the United States.

Casamigos dominates the category despite the premium price

Interestingly, Casamigos Mezcal leads the pack in sales, with 995 units sold in the Ontario region. Its success, even with a premium price tag, could point to Casamigos' substantial brand influence or a wider consumer shift towards high-end spirits.

Illegal Mezcal is a top product in US market, but not yet performing in Canada

In the U.S., Illegal Mezcal is a top performer in its category. However, in Canada, this brand has not yet replicated its American success, accounting for a mere 2% of Mezcal unit sales in recent weeks. This contrast presents an intriguing case study on brand penetration and market adaptation.

Source: Spec's Wine, Spirits, & Foods

Our Perspective: Predicting Canada's Trajectory

Mezcal in Canada should experience a significant boom, closing the gap in market penetration when compared to its neighbor to the south.

The stage is set for an accessible, brand-oriented Mezcal brand to become the go-to choice for Canadians exploring this spirit for the first time. Whether it's an established name like Madre or a new entrant seizing the market opportunity, the future looks bright for Mezcal's integration into the fabric of Canada's spirit preferences.

With strategic positioning and an understanding of consumer preferences, brands have the opportunity to tap into a market that is only just beginning to explore the rich and varied nuances of this distinctive spirit.